Traceable fixed costs are costs that can be individually attributed to the company’s certain operative unit. If TechGadget Co. decided to stop producing smartwatches, it would save the $360,000 in traceable costs related to this product. On the other hand, indirect costs, such as the factory rent, administrative salaries, and other overheads, would still remain and need to be allocated to the remaining product(s). Traceable costs exist only as a result of the existence of a particular segment within a business. Assigning common fixed costs to segments impacts the ability to improve profitability in the long run.

Traceable costs definition

The division manager or department manager will typically have control over their direct costs. Companies that are serious about increasing or sustaining margins can’t take the same approach as they did in the past or rely solely on price increases or cost passthroughs in the current inflationary environment. Instead, leaders will see real value in identifying specific, insight-based interventions to reduce costs and position their company for growth. For example, a company is planning to eliminate an entire product line, and wants to understand which expenses will be terminated when the product line is shut down. The costs traceable to the product line include advertising expenses, a marketing specialist, a production line, and a warehouse.

Understanding the ABC Method of Costing

ABC Analysis stands as a cornerstone in the edifice of inventory management, offering a systematic… Onboarding is the critical phase where customer support can shine, setting the tone for the entire… A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Significance of Traceable Costs

Controllable profit should be used to assess the manager’s performance, while traceable profit should be used to assess the division’s performance. Traceable costs include controllable costs plus other costs directly attributable to a division, but which the manager doesn’t control. In these organisations, a vital part of the head office management’s role is measuring the performance of the divisions and of divisional managers. It can help you to gain a deeper and broader understanding of your costs, and how they affect your business performance and value creation. By following the best practices and considerations discussed in this section, you can increase your chances of success and achieve your cost traceability goals.

- If there is a dip in the profitability of the company, the company’s decision-makers are likely to close down that particular unit.

- To compare costs, it is necessary to know the cost objects related to the products or activities.

- • Absolute values – use of absolute values rather than % makes it harder to compare performance between divisions of different sizes.

- Companies that are serious about increasing or sustaining margins can’t take the same approach as they did in the past or rely solely on price increases or cost passthroughs in the current inflationary environment.

- Next, the cost driver rate is computed by dividing the total overhead costs by the number of cost drivers.

Top 5 Career Options for Accounting Graduates

From the manager’s perspective, cost traceability analysis can help to improve the efficiency and effectiveness of the business process or the product. By tracing the costs from their sources to their destinations, managers can identify the cost drivers, the cost pools, and the cost objects. Cost drivers are the factors that cause costs to change, such as the number of units produced, the hours of labor, or the materials used.

As businesses strive to reduce their overhead expenses, understanding which costs are fixed and which are variable is essential. This knowledge can help managers make informed decisions about where to cut expenses without adversely affecting production levels or compromising the quality of their products. In manufacturing, the accuracy of cost data is crucial for numerous aspects of business decision making. ABC has played a pivotal role in generating cost figures that truly reflect production expenditure. Broadening the scope of overhead analysis, this innovative approach reconfigures the association between indirect costs and products.

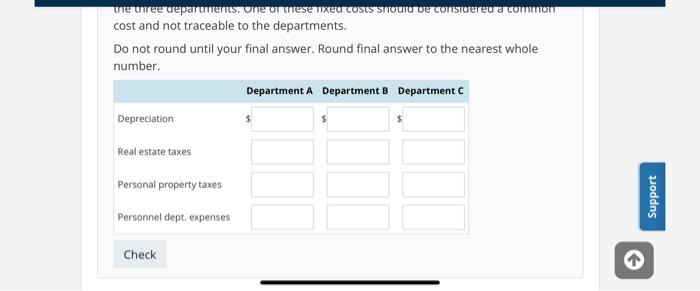

You also need to communicate and report your cost traceability results to your stakeholders, such as managers, employees, customers, and suppliers. You need to use visual and interactive tools, such as dashboards, charts, and tables, to present your cost traceability results in a clear and concise way. Remember, these are just a few examples of cost tracking tools and techniques that organizations can leverage. The choice of tools should align with specific business requirements and objectives.

Implementing ABC in a business’s accounting process directly impacts product pricing, often leading to re-evaluation and adjustments. In conclusion, the choice between activity-based costing and traditional costing depends on the specific needs and goals of a business. If improved cost analysis and enhanced strategic decision-making are priorities, transitioning to an ABC accounting system may be the right move.

A fixed cost is a monetary amount that does not fluctuate with changes in the level of output or business activity. It is one of the two main types of costs incurred by businesses, the other being variable costs. They are considered to be part of the cost of production, along with variable costs, and are therefore used in the calculation of total cost.

This rate is then factored into the cost of a product, allowing for a complete and detailed overhead cost analysis. From a strategic standpoint, cost traceability analysis provides a comprehensive traceable cost view of how costs are allocated across different departments or projects. This information is essential for evaluating the profitability and viability of various initiatives.

This can help the customer to evaluate the effectiveness and efficiency of the treatment, the fairness and affordability of the price, and the satisfaction and loyalty of the service. Costs also may be direct or indirect with respect to particular company segments or divisions. That is, some costs which are indirect for a product, may be traced to a segment or department and thus, will be direct costs for that department. A segment may mean any one of a number of things, viz., department, division, specific activity, sales territory and the like. For example, the salary of the plant manager of Plant A is a direct cost of plant A.